What Is The Bonus Depreciation For Property Place In Service In 2018

The Tax Cuts and Jobs Human activity (TCJA or the Deed) fabricated many changes to the depreciation and expensing rules for business concern avails. This tax warning will focus on 3 major provisions of the final legislation:

- Bonus depreciation

- Applicable recovery periods for real property

- Expansion of section 179 expensing

We volition first provide a summary of the new provisions past private topic, followed by a discussion of various considerations and tax planning opportunities.

Bonus depreciation

Businesses may take 100 percent bonus depreciation on qualified property both acquired and placed in service after Sept. 27, 2017, and before January. 1, 2023. Holding acquired prior to Sept. 28, 2017, just placed in service afterward Sept. 27, 2017, would remain eligible for bonus depreciation under pre-Act law (i.east., fifty per centum bonus). The conquering date for property acquired pursuant to a written binding contract is the date of such contract. Total bonus depreciation is phased down by twenty per centum each year for property placed in service after Dec. 31, 2022, and earlier Jan. i, 2027.

Under the new law, the bonus depreciation rates are as follows:

A transition rule provides that for a taxpayer'southward get-go taxable year ending after Sept. 27, 2017, the taxpayer may elect to use a 50 percent assart instead of the 100 percent allowance. Taxpayers can nonetheless elect not to claim bonus depreciation for whatsoever class of property placed in service during the taxation yr. The ballot out of bonus depreciation is an almanac election.

Due to the repeal of the corporate alternative minimum tax, the legislation also repeals the ballot to claim minimum tax credits in lieu of bonus depreciation for tax years beginning subsequently 2017.

Qualified belongings

Under the new police, qualified holding is defined equally tangible personal property with a recovery period of 20 years or less. The new law eliminates the requirement that the original use of the qualified property begin with the taxpayer, as long as the taxpayer had not previously used the acquired property and the property was not acquired from a related party. The inclusion of used property is a significant, and favorable, change from previous bonus depreciation rules.

The legislation attempted to simplify the bonus depreciation rules for qualified improvement belongings (QIP); although, due to a drafting fault, the last statutory language does not reflect the congressional intent. The Act removed QIP from the definition of qualified property for bonus depreciation purposes, merely the intent was to make QIP bonus-eligible by virtue of a 15-year recovery period. In the end, the 15-year recovery menstruation for QIP (as well as the 20-yr culling depreciation arrangement (ADS) recovery period) was omitted from the final legislation. The House Ways and Means Committee is expected to address this mistake in a technical corrections bill; however, it is uncertain if a technical corrections bill can laissez passer Congress.

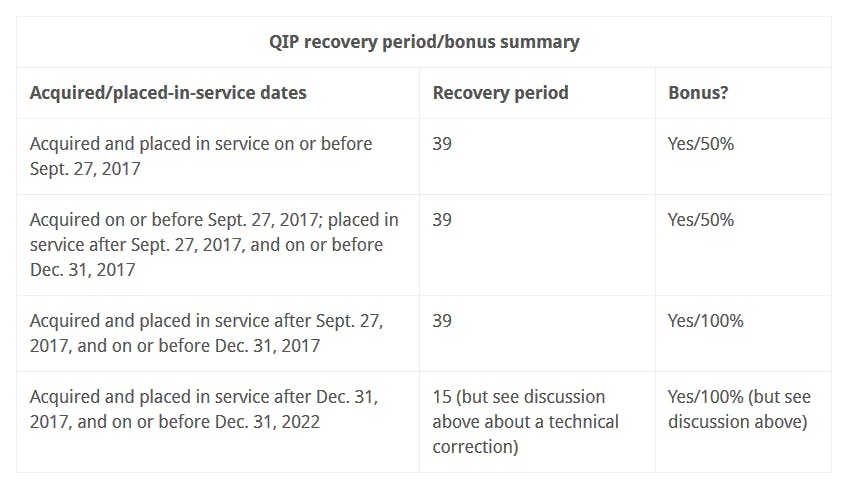

The bonus percentage for QIP placed in service in the last quarter of 2017 depends on the acquisition date of the property. QIP acquired and placed in service later Sept. 27, 2017, and before January. 1, 2018, is eligible for the 100 per centum bonus depreciation allowance. However, if the QIP was acquired prior to Sept. 28, 2017, with a written binding contract to buy the property entered into prior to Sept. 27, 2017, but placed in service later Sept. 27, 2017, the QIP would remain eligible for bonus depreciation under pre-Act law with a 50 percent bonus depreciation allowance.

Lastly, qualified property does not include: 1) property used in providing certain utility services if the rates for furnishing those services are subject field to ratemaking by a governmental entity or instrumentality, or by a public utility committee; 2) whatever property used in a merchandise or business that has floor plan financing indebtedness; and iii) property used in a existent property merchandise or business that makes an irrevocable election out of the interest expense deduction limitation nether department 163(j). Under the involvement expensing provisions, these entities would have to depreciate residential real property, nonresidential existent belongings and QIP nether the ADS and, therefore, such holding would not be eligible for bonus depreciation.

Applicable recovery periods for existent property

The new law retains the current Modified Accelerated Cost Recovery System (MACRS) recovery periods of 39 and 27.5 years for nonresidential and residential rental property, respectively. However, the ADS recovery menstruation for residential rental property is reduced to 30 years from 40 years effective for property placed in service on or afterwards January. 1, 2018.

The Act also eliminates the divide definitions of qualified leasehold improvement, qualified eating house and qualified retail improvement property, and provides simplification with a general fifteen-year recovery period for QIP (and 20-yr ADS recovery period) [see discussion above virtually technical correction]. QIP is any improvement to an interior portion of a building that is nonresidential existent property if the improvement is placed in service afterward the date the edifice was first placed in service, excluding: enlargements, elevators/escalators and internal structural framework. The improvements practice not demand to exist made pursuant to a lease.

For instance, QIP placed in service afterward Dec. 31, 2017, mostly is depreciable over xv years using the straight-line method and half-year convention without regard to (ane) whether the improvements are property subject to a lease, (2) placed in service more than three years after the engagement the building was first placed in service, or (3) made to a eating house edifice. The Act clarifies that restaurant building property placed in service after Dec. 31, 2017, (that does not meet the definition of QIP) is depreciable over 39 years every bit nonresidential real belongings using the straight-line method and the midmonth convention.

Electing real property trades or businesses

As noted above, a real property merchandise or concern that elects out of the involvement expense deduction limitation must use ADS to depreciate nonresidential real property (twoscore years), residential rental property (30 years) and QIP (20 years). The modifications to the ADS recovery period for residential rental property (twoscore years to xxx years) equally well equally the xx-year ADS recovery period for QIP (versus 40-year under pre-Act law) may provide an opportunity for sure taxpayers in existent holding trades or businesses to shorten their recovery periods while at the same fourth dimension electing out of the involvement limitation. An election out would crave taxpayers to treat a alter in the recovery menses and method equally a alter in use (if affecting property already placed in service for the year the election is made).

The recovery period provisions apply to property placed in service after Dec. 31, 2017.

Expansion of department 179 expensing

The Human action increases the maximum amount a taxpayer may expense under section 179 to $1 million and increases the investment limit (also referred to as the total amount of equipment purchased or phase-out threshold) corporeality to $2.5 one thousand thousand. The $1 1000000 limitation is reduced (just not below zero) by the amount by which the cost of qualifying property placed in service during the taxable year exceeds $2.5 million. Both amounts are indexed for inflation for taxable years commencement after 2018.

The Deed expands the definition of section 179 holding to include certain depreciable tangible personal belongings used predominately to furnish lodging or in connection with furnishing lodging (i.e., beds or furniture used in hotels and apartment buildings). The definition of qualified real property for section 179 purposes was also expanded to include any of the following improvements fabricated to nonresidential existent property: roofs, heating, ventilation and air-conditioning holding, fire protection and alarm systems and security systems as long equally the improvements are placed in service after the date the edifice was first placed in service.

The provision applies to property placed in service in taxable years offset after Dec. 31, 2017.

Planning considerations

The new expensing and cost recovery rules may significantly change the analysis for toll recovery, similar to when the de minimis election and other elections and accounting methods were added under the repair regulations. Determining the appropriate tax handling for tangible property expenditures may require a "decision tree" analysis beginning with identification of items that authorize for a current deduction under existing rules (i.e., repairs or incidental materials and supplies), and then identifying other exceptions and applying every bit appropriate. For instance, a taxpayer may first apply conformity to fiscal statement expensing, where possible, using the de minimis rules. Then, apply bonus depreciation and department 179 for items ineligible under the de minimis rules, considering respective eligibility and phase-out thresholds to maximize the tax benefit.

Bonus versus department 179. Consideration and comparison of bonus depreciation and section 179 is critical in planning for depreciation deductions. Both result in substantial nowadays value tax savings for businesses that already had plans to purchase or construct qualified belongings. Unlike section 179 expensing, however, taxpayers do not need internet income to take bonus depreciation deductions. Additional tax planning in relation to the new cyberspace operating loss (NOL) limitations – also as the new limitation on losses of noncorporate taxpayers – will be necessary in these situations. Further, bonus depreciation is non limited to smaller businesses or capped at a certain dollar level equally under section 179, where larger businesses that spend more than the investment limitation on equipment will non receive the deduction. Lastly, the years in which full expensing is available may offset the bear upon where the section 179 deduction may not exist allowed due to either the expensing or investment limitations.

Qualified real property under section 179. The increase in both the section 179 expense and investment limitations besides every bit the expansion of the definition of qualified real belongings would besides provide firsthand expensing to taxpayers that invest in certain qualified real holding (particularly for property that is not eligible for bonus depreciation). The expanded definition of real holding under section 179 may too be able to beginning situations in which certain building replacement belongings would have otherwise been capitalized nether the repair regulations (if on a repairs method). For example, if nether the repairs analysis, it is determined that one of two HVAC units requires capitalization under the restoration rules, the unit may be qualified real property and deducted as a section 179 expense, assuming inside the expensing and investment limitations.

State decoupling. Nosotros expect many states to decouple from 100 percent bonus depreciation as well equally the increased per centum 179 amounts.

Used holding. Including used property in the definition of qualified property for bonus depreciation has a potentially significant bear on on M&A restructuring as bonus depreciation at present applies to qualified property acquired in a taxable acquisition. In asset acquisitions, either bodily or accounted under department 338, capitalized costs added to the adjusted basis of the acquired holding may be able to exist fully expensed if allocable to qualified property. Structuring taxable transactions as nugget purchases rather than stock acquisitions may result in an firsthand deduction of a portion of the purchase price in the acquisition twelvemonth or generate NOLs that take favorable tax planning consequences in connectedness with the new NOL rules.

Placed-in-service date. Considering of the meaning touch of 100 pct bonus depreciation, more scrutiny is predictable effectually the determination of the placed-in-service date of an asset. Before the Act, taxpayers generally wanted an earlier placed-in-service date in order to accelerate depreciation deductions. Nether the new law, taxpayers may attempt to back up a later placed-in-service date to claim the 100 percent versus l per centum bonus depreciation allowance.

For depreciation purposes, property is considered placed in service when the asset is set and bachelor for apply in its intended function. Taxpayers ofttimes larn depreciable assets such as machinery and equipment before they begin their intended income-producing activity. In these situations, generally depreciation deductions may not be claimed for the machinery and equipment before the taxpayer'southward business starts and the depreciating asset is used in that activity.

This guideline is peculiarly important for belongings acquired prior to Sept. 28, 2017, but placed in service after Sept. 27, 2017, that would remain subject to l percent bonus depreciation under pre-Act constabulary. A taxpayer may take acquired equipment prior to Sept. 28, 2017, but did not place the nugget into service until after Sept. 27, 2017, when a facility was opened and the equipment was used in that income-producing activity. On the surface, since the asset is placed in service after Sept. 27, 2017, full expensing appears to apply. However, because the asset was acquired prior to this date, information technology is only eligible for 50 percent bonus. Both acquisition and placed-in-service dates volition crave a detailed review of the facts and circumstances to brand sure the appropriate bonus depreciation allowance is claimed.

Elections. Elections that reduce almanac depreciation deductions (ballot out of bonus depreciation, annual election to use ADS, etc.) will also get more critical in revenue enhancement years showtime on or after Jan. 1, 2022, when depreciation deductions will reduce "adjusted taxable income" for purposes of the interest deduction limitation. It will become increasingly important to model out the bear upon of various depreciation elections for planning purposes.

Cost segregation studies. Consideration of a cost segregation study is now more of import than ever. A price segregation written report is an in-depth assay of the costs associated with the construction, acquisition or renovation of endemic or leased buildings for proper tax classification and identification of assets that may be eligible for shorter taxation recovery periods resulting in accelerated depreciation deductions. The reclassification of assets from longer to shorter tax recovery periods may too brand these avails eligible for bonus depreciation resulting in even more substantial nowadays value tax savings, specially with full expensing for qualified property placed in service afterwards Sept. 27, 2017. Tangible personal property identified in the toll segregation of acquired property placed in service subsequently Sept. 27, 2017, will now be qualified holding for bonus depreciation purposes since the definition of qualified property was expanded to include used property.

Cost segregation is especially disquisitional to existent property trade or businesses that may not claim bonus depreciation on QIP considering of the election out of the interest deduction limitation. These entities may desire the tax benefit from the reclassification of personal property to shorter tax recovery periods resulting in accelerated depreciation deductions. The modification to the recovery menses under ADS (to xxx years from 40 for belongings placed in service after Dec. 31, 2017) for residential rental property, likewise equally the twenty-year ADS recovery flow for QIP, also provides these existent estate taxpayers with the power to recover real property over shorter recovery periods.

Permanent revenue enhancement reductions resulting from accelerated depreciation deductions may also exist considering of the tax rate reduction in 2018. Taxpayers that constructed, renovated or acquired a building placed in service in 2017 may want to consider a cost segregation study to maximize tax deductions. Alternatively, if the edifice was placed in service prior to 2017 and no cost segregation report was done at the time, a retroactive toll segregation written report can be washed in 2017 and the department 481(a) catch-upwardly adjustment can all be claimed on the 2017 revenue enhancement return past filing a change in accounting method. Both may generate a one-time permanent tax savings by accelerating deductions in 2017 at 2017's college revenue enhancement rates.

We recommend modeling out the potential taxation implications of performing a cost segregation written report in 2017 versus 2018 with the new lower tax rates as well every bit careful assay of the placed-in-service appointment and the impact on the bonus depreciation allowance.

For related insights and in-depth assay, run across our taxation reform resource center.

For more information on this topic, or to learn how Baker Tilly revenue enhancement specialists can help, contact our team.

The information provided hither is of a general nature and is non intended to address the specific circumstances of whatever individual or entity. In specific circumstances, the services of a professional person should be sought. Tax data, if any, contained in this communication was not intended or written to be used by whatever person for the purpose of avoiding penalties, nor should such information be construed every bit an opinion upon which any person may rely. The intended recipients of this advice and any attachments are non subject to whatsoever limitation on the disclosure of the tax treatment or tax construction of any transaction or matter that is the subject field of this communication and any attachments.

What Is The Bonus Depreciation For Property Place In Service In 2018,

Source: https://www.bakertilly.com/insights/bonus-depreciation

Posted by: olaguebrid1984.blogspot.com

0 Response to "What Is The Bonus Depreciation For Property Place In Service In 2018"

Post a Comment